New Blogger

Well hello there!

I'm new to blogging. How does this go?? I have done some blogs where you repost another article and add a comment. The last two blogs have been my own, but felt so formal. Probably too focused on the data and educational bit.

Driving up to Portland this afternoon for a weekend long seminar I listened to some Tim Ferris podcasts. Talk about a fascinating guy! If you haven't read any of his books or listened to any of his podcasts I encourage you to check them out. Today I listened to three of them. With different people talking about completely different subjects. One was on investing, another on morning routines, and another with Seth Rogen and Evan Goldberg. While they were all educational and entertaining in their own right I recognized that what made them all so facinating was that each person he interviewed was being their best selves. Whatever that may be.

I've known that the best we can be is our truest self – cognitively. But I haven't fully embraced it yet in my heart. I hit the zone in whatever I'm doing; from athletics to working with clients, when I am being my truest self. And yet with preasures both external and self inflicted sometimes I struggle.

One of the first things I thought about to help practice and reinforce being more open and truly me was to blog. Blog as me. More conversational. The best experiences in life are often just that – people being themselves together. Being vulnerable.

Gasp – so not me. I'm not good with vulnerable. Yet, here I am blogging my voice. I am not convinced this is the answer to living more fully me, but it's definitely worth a try.

In the meantime (great book, by the way), maybe you'll learn a little more about who I am. Some new clients recently met me for coffee to chat and get to know each other. While they shared about themselves and their family I was fascinated to hear their life stories. What inspiring people these two were to overcome and have such an amazingly positive attitude. There is something so pure in seeing the hero in the people you meet everyday. At the end of our time together that day they commented that they hadn't learned much about me. I know I'm a good listener – but I would also like to develop the skill of sharing. Being vulnerable and open – at least a little more. Let's not get crazy. 😛

My goal with this blog is for you to get to know Coach Gina. To share things about my industry that will be beneficial to you. To create something that people look forward to reading because it is fun, easy to read, and they get a little something out of it each time.

Also – I'd love to hear what you think or what topics you'd like to see more of.

Hugs!! – Coach Gina 🙂

New TRID requirements

October is here!

October always means – leaves are changing, warm drinks abound, and Halloween is coming (scary movies, costumes, and candy!). It’s a fun month that usually brings great weather.

This year – we are seeing a big change coming to all levels of real estate. TRID requirements are rolling out. It is the last of the federally mandated changes rolling out because of the crash (Dodd- Frank Wall Street Reform and Consumer Protection Act). This will affect escrow, lenders, and real estate agents – but ultimately buyers and sellers.

Here’s some of the changes as I understand them. How they play out will varry depending on your agents involved on all levels.

1) This will affect loan apps taken after today. So if you are currently in a transaction it should not affect you.

2) Standardized Loan Estimate and Closing Disclosure forms.

3) Closing Disclosures to be signed 3 days before closing.

What does this mean for the buyer and seller?

1) If you are looking at buying or selling in the near future: talk with me! There are things to be aware of and educated about so you can move through this transititon seamlessly!

2)The new forms are CLEAR! This is a very good thing. It will be easy to see what you are signing up for (loan) and what your terms are. It will also make shopping around and comparing lenders easier due to the standardized forms.

3)With the closing disclosures to be signed 3 days before closing there will be an extension to the amount of time a standard loan can close. We will probably be seeing more 45 day closes. If there are changes after the closing disclosures are signed they will need to be RE disclosed and another 3 day waiting period. The intent is to protect the consumer and require lenders and closing officers (escrow) to be VERY accurate. Change of APR by more than 1/8%, adding a prepay, or a change in loan program will all REQUIRE a redisclose and another 3 day waiting period.

As with any change there will be bumps. Expect some delays as all of us helping you through your transaction figure out the new regulations. In the long run this will be a good thing for the industry.

Please don’t hesitate to ask if you have questions about this or any other real estate need. I am here to help!

Happy Fall! and FHA changes

Today is the second day of fall. As I exhale into a new season and break out the sweaters and warm drinks; I reflect on change.

The leaves are changing. The air is crisp. Here in Eugene, OR we have some rainy and some sunny days still. A new season of swim and coaching has started with a renewed sense of vigor and focus. Kids are back to school in a new grade, some are at new schools, new teachers, perhaps new friends. Fall brings with it a sense of excitement for a new year and a release of summer and the last year. Release. Release the past and focus on the present.

Today, at the office, was a class taught by David Kammerere and Robyn LaVassaur from Summit Funding. We talked about changes. Mostly changes to FHA loans that took effect Sept 14. Fall is still a great time to buy. If you are thinking of going FHA for your home loan make sure you talk with your lender about these changes.

- Gift Funds – must be sourced (even if wired). I’m imagining a young couple buying their first home and perhaps Mom and Dad are gifting their down payment. Now Mom and Dad need to prove to the lender they had the money to give.

- Student Loan Payments – whether deferred or not, will have to be counted either with the scheduled payment due after deferment or 2% of the total amount. This had not been the case before. I would caution families looking to college to consider how this will affect their buying power once out of college. Consider carefully your degree program and your funding needed and will it make sense once you are out? This also makes me think it is a more accurate assessment of a person’s financial position. It also seems to divide those that have and those that don’t with the continuous rise of higher education prices.

- Authorized User Accounts – have to be counted in the debt ratio unless you can get 12 months of canceled checks from the owner on the account. Business card? On a parents credit card? Now your business or place of employment needs to show they are making the payments and not you. Sometimes this is an asset when a parent can help a young person establish credit.

- Voluntary Alimony and Child Support – now accepted by FHA with 6 months receipt to document. This is a positive thing for those that didn’t go through the courts to establish payments. Yay!

- 30 day accounts – can be omitted from the DTI (debt to income) with 12 months evidence of the balance being paid in full and on time. If unable to document 5% of the balance will be included in the DTI. This is important for those of us with mileage cards who charge everything and then pay it off every month! Although if you are this diligent with your money you may be going conventional.

- Social Security – gross will be adjusted 15% instead of 25%. Not a huge change, really. Those on fixed income got to count up their income because it wasn’t taxed. Hmmm, the money still isn’t there – so the whole concept seems weird to me. Never the less – that’s how this one works.

- Employment – If employee has changed jobs more than 3x in the last 12 months or has changed line of work, it will be more difficult to document stability. This is the human component! A human underwriter is looking at your life an deciding if they will put their name on your loan and rate you as stable. Interesting! I’m glad there is a still a human component, actually. If this is your situation this may be a time where an explanation letter goes a long way. Hope you were paying attention in English class.

- Unemployment Gaps – If more than 6 months, will require at least 6 months on the new job before the case number is pulled. Did you realize you do not need to show 2 years at one job? Did you know if you have a steady contract job but the work is seasonal that doesn’t apply here? No shopping for homes until you have 6 months on a job after a 6 month hiatus.

- Short Sales, Foreclosures, and Bankruptcies – must be seasoned per normal guidelines prior to pulling the case number. Again – no home shopping until the seasoning period is over. You cannot have a case number til then. Wow! This used to be the close date! Check with me or your lender if you are not sure of your seasoning date! Did you know foreclosure seasoning dates start when the bank takes title? Not when you are moved out. Check to make sure title has transferred!

- NHF Platinum – GRANT money, not a second mortgage and doesn’t have to be your first home! This is intended to help with your down payment. It does need to be a primary residence, BUT you can be leaving one that you will rent and purchasing another. What?!?! Sounds awesome – cause it is :). Check with me or your lender today to see if this is the right program for you!!

What other change is right around the corner?? New TRID guidelines that will affect escrow, lenders, buyer, sellers….everyone in the real estate market. Let me know if you’d like to know more!

– Coach Gina

“Those who contemplate the beauty of the earth find resources of strength that will endure as long as life lasts.”

Rachel Carson

Pending Sales Surge

I've had a lot of questions lately about how the market is doing. Here is an article about just that! Call me or let's get together – I love talking real estate. – G

Pending Sales Surge: Great Sign for the Housing Market

The most recent Pending Homes Sales Index from the National Association of Realtors revealed that homes going into contract in February increased to their highest level since June 2013.

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The Index is now 12.0 percent above February 2014. The index is at its highest level since June 2013, has increased year-over-year for six consecutive months and is above what is considered “the average level of activity” – for the 10th consecutive month.

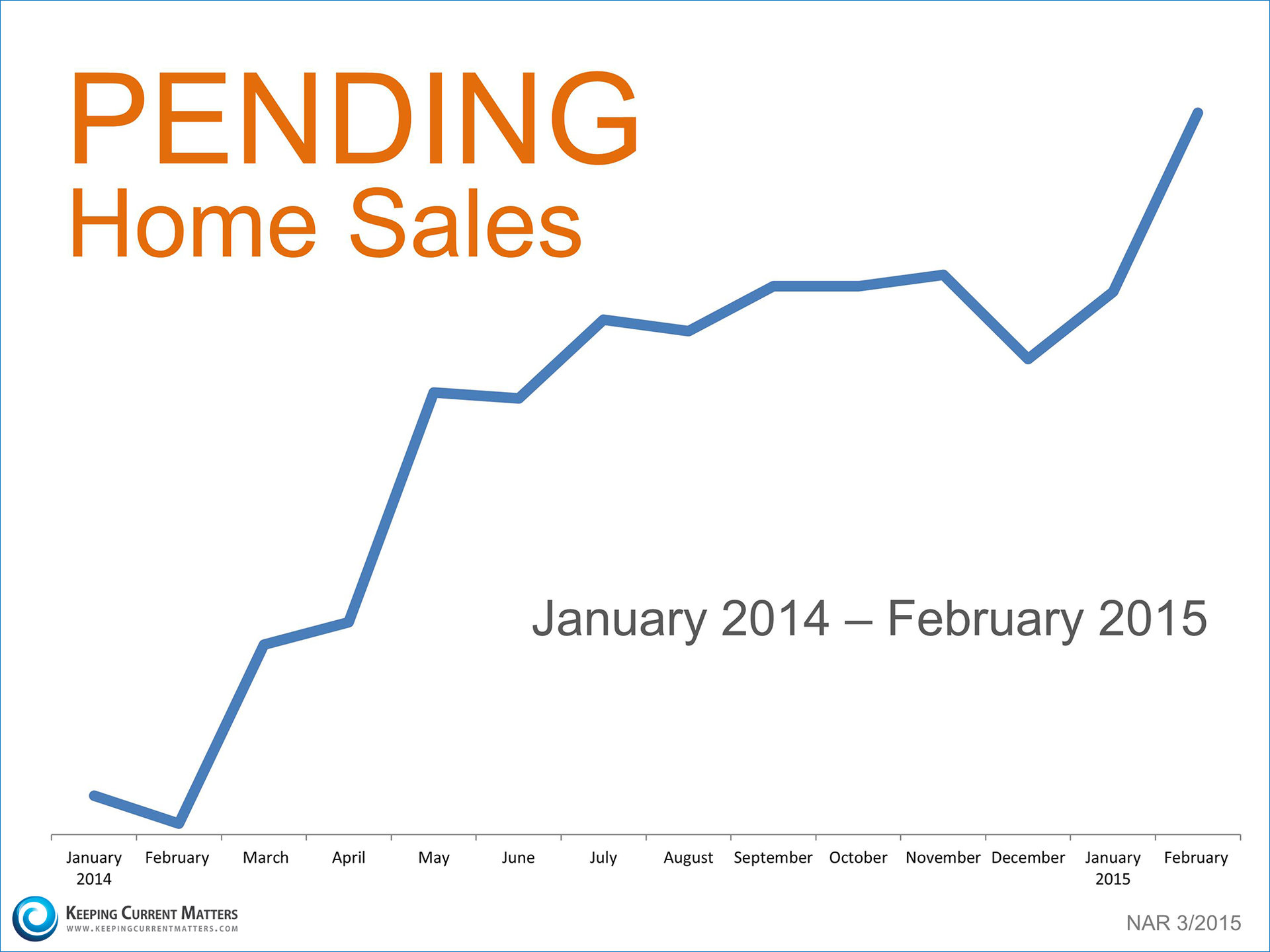

Here is a graph showing the Pending Sales numbers:

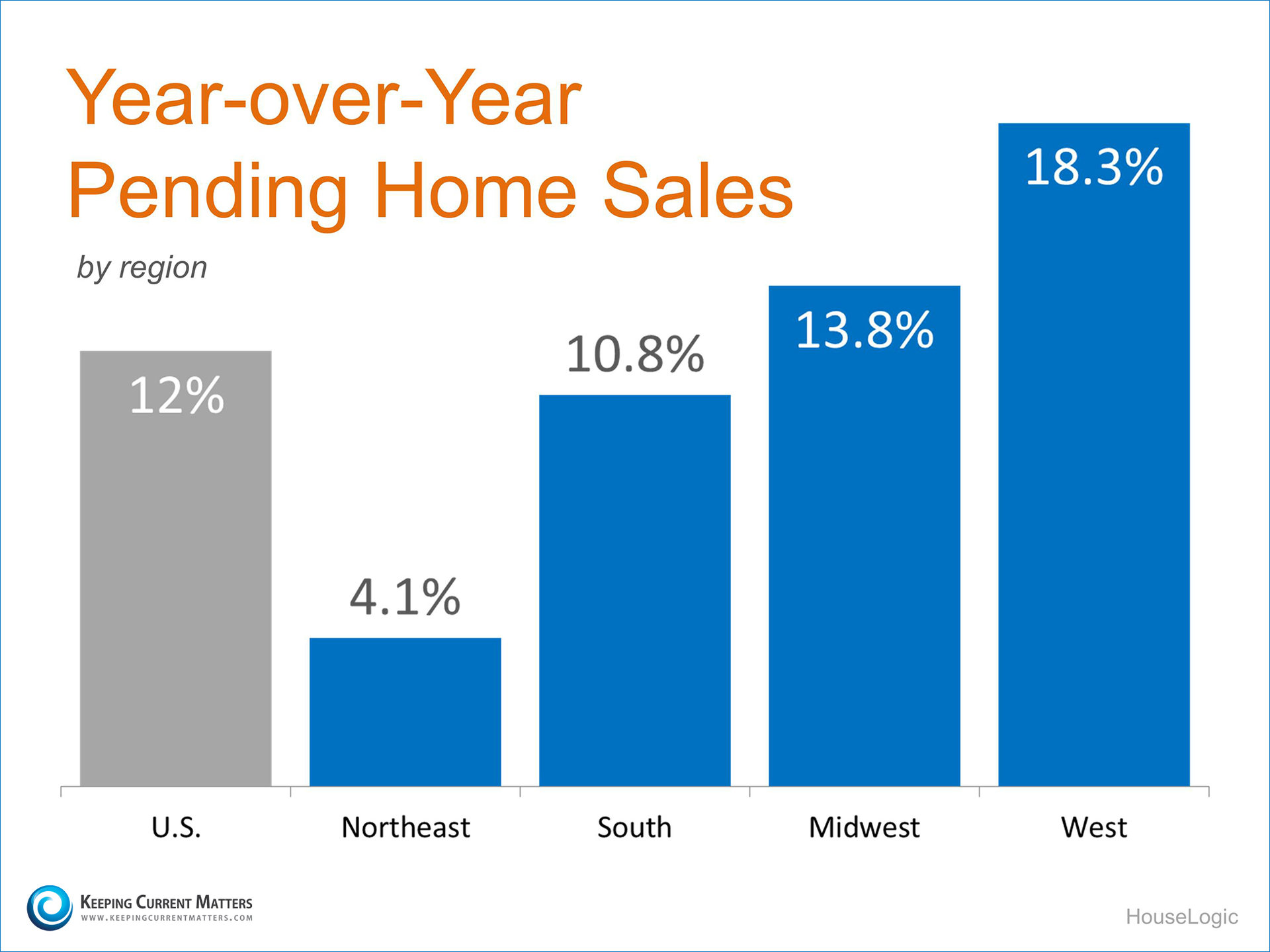

Here is a chart showing the Pending Sales increases by region:

Bottom Line

In an article from Investors’ Business Daily, Lawrence Yun, Chief Economist at the National Association of Realtors, explained what these numbers will mean to the overall market:

"It looks like the buyers want to come out to the market and they are eager to find the right home and make an offer. Therefore, I expect the second quarter of this year to be easily ahead of last year in terms of sales activity. Pending contracts are implying that the closing activity in coming months will be quite solid."

Freddie Mac: 2015 Home Sales to HIt 2007 Levels

Freddie Mac: 2015 Home Sales to Hit 2007 Levels

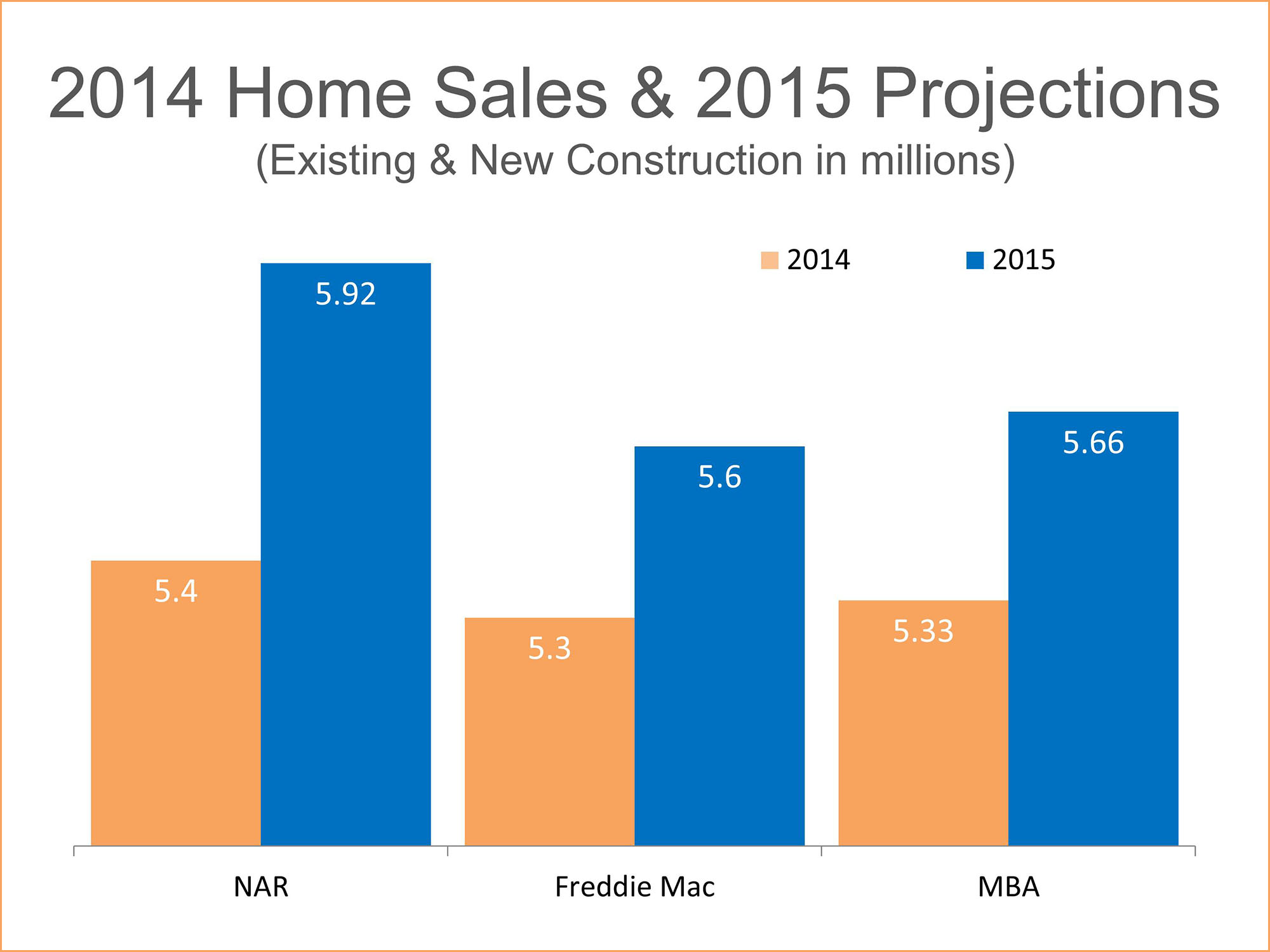

According to Freddie Mac’s latest U.S. Economic & Housing Market Outlook, U.S. home sales in 2015 will show increase to the numbers associated with a normal real estate market. Here is their projection:

“We are projecting a 4 percent rise in sales to 5.6 million, which would mark the highest level of annual sales since 2007.”

And their optimism was seconded by both the National Association of Realtors (NAR) and the Mortgage Bankers Association (MBA).

It seems that an improving economy and jobs market will mean a very healthy housing market.

Add Some Sparkle to Your Holidays with Gilded Décor

Posted November 18 2014, 12:09 PM PST by Tiana Baur

Add Some Sparkle to Your Holidays with Gilded Décor

Posted in Living by Tiana Baur

In October we started to see gold amongst our pumpkins, but this fall get ready for all gold everything. From gilded pears to golden leaves, there’s something here for everyone.

Gilded Pears – Use real or fake pears, whichever you prefer, spray paint gold, and allow them to dry completely. You can add little flags to the top if you’re really feeling crafty.

Magnolia Wreath – Collect some Magnolia branches and use a wreath frame as a base. Spray paint the green side of each leaf with gold and then assemble using wire. Supposedly it’s not as complicated as it looks!

Dipped Pinecones – First, you’ll want to make sure your cones are clean and dry. Apply gold leaf adhesive using a foam brush; deciding how much you add will determine how much of the cone is covered in gold. After they dry, it’s time to add gold leaf, which comes in whisper thin sheets about 5” square. Wrap it around the cone and use a clean foam brush to rub it into the adhesive. Then give it a light spray with sealant and allow them to dry.

Gold Acorns – Hand pick your acorns, clean, and oven-dry them to make sure they are pest free. Paint them gold and then add a layer of clear shellac for a shiny look. Lastly, you’ll want to use a hot glue gun to attach the caps since they naturally fall off after the acorns dry. You can use these as filler in a glass vase or simply scatter them on a tabletop.

Shimmering Maple Garland – All you’ll need is a bag of artificial leaves, bought at any craft store, some Elmer’s glue, glitter, and string. Use a paintbrush to apply glue to each leaf and sprinkle lots of glitter over them. Let the glue set, then shake of the excess glitter, punch a hole at the top and attach a ribbon. Tie them all to a large strand and voilà, a perfect garland for the holidays.

Petite Pumpkins – If you are still head over heels for pumpkins, then using small ones for place cards will add some spice to your table. Tape each pumpkin halfway with painters tape, it can be horizontal, diagonal, you pick! Next paint the bottom portion with gold craft paint (may need multiple layers) and with the last layer still wet, generously sprinkle gold glitter over the painted half. After your pumpkin is dry and you’ve shaken off the excess glitter, wrap beading foil tightly around the stem. Leave a little extra at the end for you to bend for your place card.

Check out more ideas on our Gilded Fall Décor board on Pinterest.

Windermere Foundation Quarterly Report

Posted November 11 2014, 9:36 AM PST by Christine Wood

Windermere Foundation Quarterly Report

Posted in Community by Christine Wood

Thanks to the generosity of donors like you, the Windermere Foundation was able to provide over one million dollars in support during the first three quarters of this year to social service organizations that helped hundreds of families meet basic needs.

Programs which benefit children and youth continue to receive a significant portion of Windermere Foundation funds. These funds are made possible by your continued support.

The Launch Pad, a teen center in Prescott, Arizona, received a grant to support their after-school programs.

“Research shows that the most vulnerable hours of the day for youth are between 3 and 6 p.m., Monday through Friday,” according to a representative from The Launch Pad. “These happen to be the times that youth commit the most crimes and have the most crimes committed against them. Furthermore, youth-attempted suicides predominantly happen between these same hours. The Launch Pad focuses on these hours and helps intervene in high-risk behavior by providing enriching and empowering activities and workshops.”

Fill a Backpack, Make a Smile is a non-profit organization in Walla Walla, Washington that provides backpacks with school supplies for kids and families in the Milton Freewater School District who may not be able to afford them. A grant supported their efforts to help ensure over 150 kids received backpacks, supplies, two new shirts and help with payment of middle and high school fees.

Fill a Backpack, Make a Smile is a non-profit organization in Walla Walla, Washington that provides backpacks with school supplies for kids and families in the Milton Freewater School District who may not be able to afford them. A grant supported their efforts to help ensure over 150 kids received backpacks, supplies, two new shirts and help with payment of middle and high school fees.

The Marvin Thomas Memorial Fund in Seattle, Washington received a grant from the Windermere Foundation to help with the purchase of backpacks for more than 500 low-income children/youth. Its mission is to provide positive, supportive and safe programs for children, as well as food, fun, educational opportunities, interactions and working relationships with the community and other agencies to serve as “the village” in raising a child.

Assistance League of Greater Portland received a grant which supports Operation School Bell. “Thanks to the generosity of supporters like Windermere, we are able to provide clothing for more than 2,600 economically disadvantaged school children a year,” said a spokesperson for Assistance League of Greater Portland. “Education is vital to breaking poverty barriers for children and Operation School Bell plays a role in ensuring that these students may attend school confidently, appropriately dressed like their peers, and ready to learn.”

DONATIONS & GRANTS

- Donations collected through third quarter 2014: $1,184,381.40

- Percent raised through individual contributions & fundraisers: 64%

- Percent raised through transactions: 36%

- Number of grants awarded: 405

- Average grant size: $2,559

If you’d like to help, click on the Donate button to make a donation.

Visit http://www.windermere.com/foundation to learn more about the Windermere Foundation, and remember to read the Windermere Blog for more in-depth stories about what our offices are doing throughout the year.

Thank you for your continued support of the Windermere Foundation. Your generosity is truly making a difference in the lives of many families in our local communities.

Best,

Christine Wood

Executive Director

Windermere Foundation

5 Reasons You Shouldn’t For Sale by Owner

5 Reasons You Shouldn’t For Sale by Owner

Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

Here are five of our reasons:

1. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to FSBO.

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies which work for the buyer and will almost always find some problems with the house

- The appraiser if there is a question of value

- Your bank in the case of a short sale

2. Exposure to Prospective Purchasers

Recent studies have shown that 92% of buyers search online for a home. That is in comparison to only 28% looking at print newspaper ads. Most real estate agents have an extensive internet strategy to promote the sale of your home. Do you?

3. Actual Results also come from the Internet

Where do buyers find the home they actually purchased?

- 43% on the internet

- 9% from a yard sign

- 1% from newspapers

The days of selling your house by just putting up a sign and putting it in the paper are long gone. Having a strong internet strategy is crucial.

4. FSBOing has Become More and More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 9% over the last 20+ years.

5. You Net More Money when Using an Agent

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real commission. The seller and buyer can’t both save the same commission.

Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.

Bottom Line

Before you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer.

Millennials: How Many are Actually ‘Living with their Parents’?

Millennials: How Many are Actually 'Living with their Parents'?

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimation of their actual home purchases, evidence is beginning to debunk the myths many have held about this generation and homeownership. Now, one more strongly held belief is being questioned.

Do Millennials Live in their Parents Basements?

It seems not as many as once was reported. Our friends at Calculated Risk (CR) alerted us to a post by Derek Thompson in the Atlantic: The Misguided Freakout About Basement-Dwelling Millennials. The article explains that according to the Census Reports:

“It is important to note that the Current Population Survey counts students living in dormitories as living in their parents' home.”

What?!? If you live in a college dorm, the census counts you as living with your parents. Thompson has some fun with this when he explains:

“When you were adjusting to your freshman roommate, you were ‘living with your parents’. When you snagged that sweet triple with your best friends in grad housing, you were ‘living with your parents’. That one time you launched butt-rattling bottle rockets at the stroke of midnight off your fraternity roof? I hope you didn't make too much noise. After all, you were ‘living with your parents’."

The data is “Criminally Misleading”

According to Thompson, the counting of those living in college dorms as living with their parents is “criminally misleading”. He explains that part of the increase in these numbers is actually attributed to the fact that more people are attending college:

“[T]he share of 25- to 29-year-olds with a bachelor degree has grown by almost 50 percent since the early 1980s. More than 84 percent of today's 27-year-olds spend at least some time in college and now 40 percent have a bachelor's or associate's degree. More young people going to school means more young people living in dorms, which means more young people ‘living with their parents’, according to the weird Census.”

Thompson then goes on to reveal that:

"[T]he share of 18-to-24-year-olds living at home who aren't in college has declined since 1986. But the share of college students living "at home" (i.e.: in dorms, often) has increased.

So the Millennials-living-in-our-parents meme is almost entirely a result of higher college attendance.” (emphasis added)

The Other Side of the Argument

However, Trulia’s chief economist Jed Kolko, doesn’t totally agree. In a post in response to the Thompson article, Kolko explains:

“The Current Population Survey’s (CPS) Annual Social and Economic Supplement (ASEC) counts college students who are living in dorms as living with their parents, and college enrollment has indeed gone up. But it does not follow that basement-dwelling millennials are a myth. The ASEC and other Census data show that after adjusting for college enrollment and for dormitory living, millennials were more likely to live with parents in 2012 and 2013 than at any other time for which a consistent data series is available.”

Bottom Line

There are more Millennials living with their parents than ever before. However, the numbers being quoted by some seem to be exaggerated.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![The Cost of Renting vs. Buying [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/09/Rent-vs.-Buy-1500.jpg)